How to Remove a Pfister Bathroom Faucet?

In this comprehensive guide, we’ll walk you through the steps to successfully remove a Pfister bathroom faucet. Whether you’re upgrading your fixtures or performing maintenance, … Read more

In this comprehensive guide, we’ll walk you through the steps to successfully remove a Pfister bathroom faucet. Whether you’re upgrading your fixtures or performing maintenance, … Read more

In the realm of bathroom luxuries, few things rival the indulgence of sinking into a deep soaking tub after a long, tiresome day. But what … Read more

When it comes to designing a bathroom, choosing the right color scheme is essential for creating a cohesive and visually appealing space. Blue bathroom tiles … Read more

In recent years, wall mounted vanities have gained popularity in bathroom designs due to their modern aesthetic and space-saving benefits. However, concerns about their safety … Read more

In the modern era, wall-mounted TVs have become a staple in households worldwide. They offer sleek designs, space-saving solutions, and a cinematic viewing experience. However, … Read more

Installing a wall-mounted vanity can transform the look and functionality of your bathroom. Not only does it create a modern and sleek aesthetic, but it … Read more

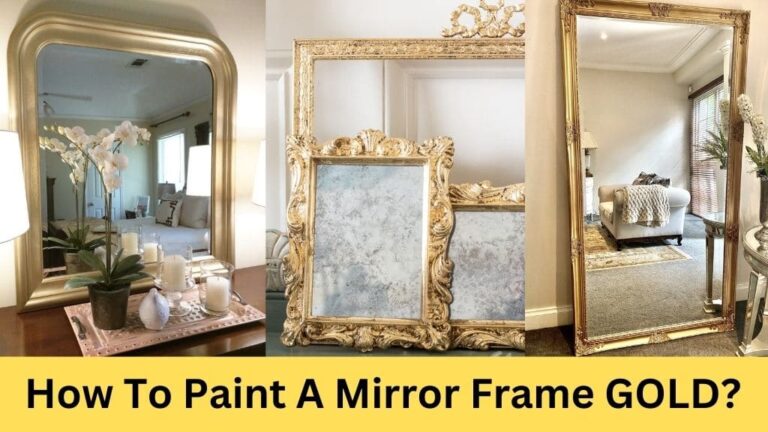

In interior design, mirrors serve not only as functional pieces but also as decorative elements that can enhance the aesthetics of any space. While gold-framed … Read more

In our daily routines, the bathroom mirror serves as a reliable companion, reflecting our appearance as we prepare for the day ahead. But have you … Read more

Bathrooms are essential spaces in our homes where we start and end our days. From personal grooming to relaxation, the bathroom serves various functions. One … Read more

Maintaining a clean bathroom is essential not only for aesthetic purposes but also for your health and the longevity of your home. One often overlooked … Read more